Analyst Predicts Ethereum’s Path to $8,000: Key Milestones Ahead

Ethereum’s Journey Towards an $8,000 All-Time High A prominent crypto…

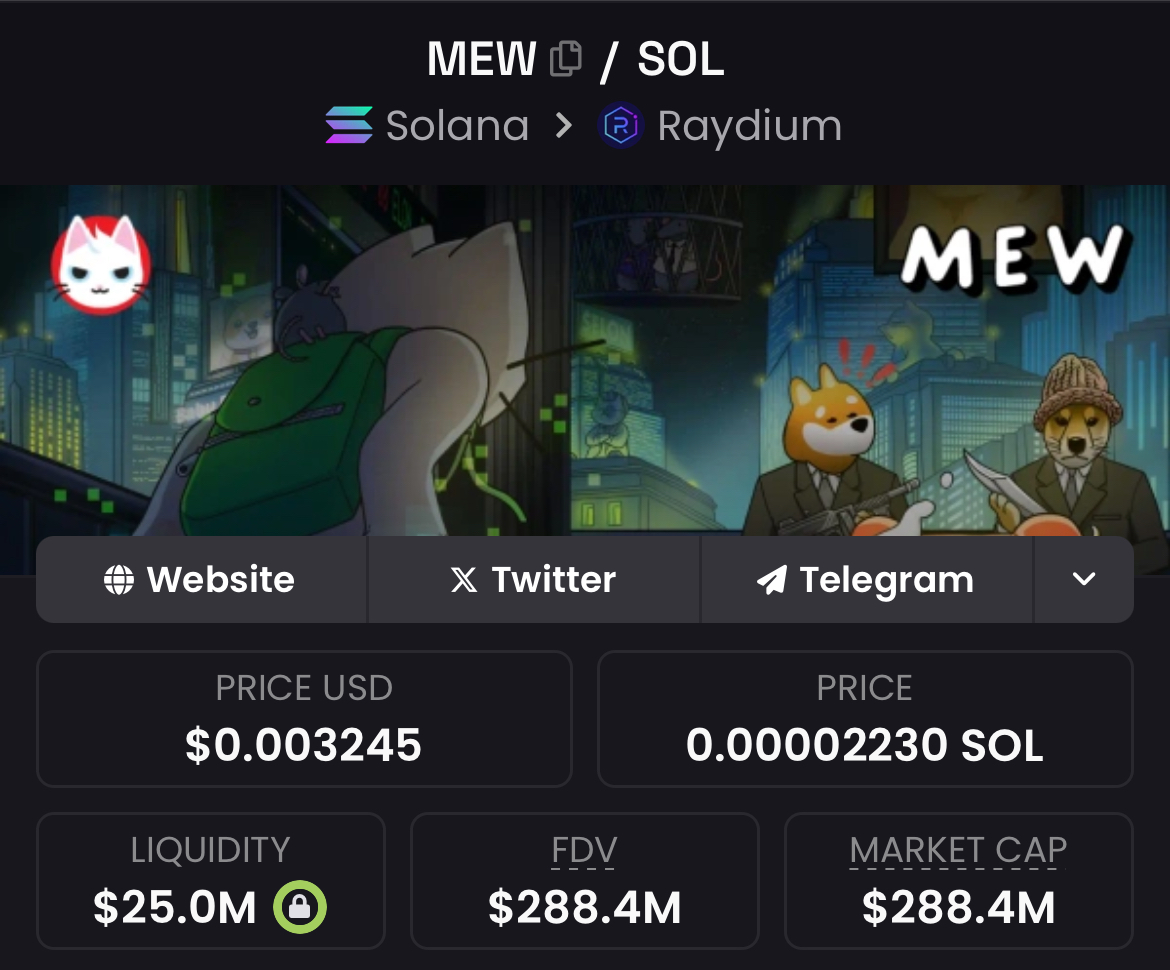

In the vast universe of cryptocurrency, meme coins often shine the brightest, capturing the imagination and wallets of investors looking for high potential returns. Among these, the Solana-based MEW token stands out not just for its quirky branding but also for its robust performance in the crypto market. With a solid market cap of $289 million, $MEW has firmly established itself as a top player in the meme coin sector, attracting “smart money” with its promising market dynamics.

$MEW’s prominence within the Solana ecosystem and the broader cryptocurrency market is not accidental. It leverages Solana’s high-speed and low-cost transactions, making it an attractive asset for rapid trading and micro-transactions, which are typical in the meme coin community. The token’s ability to maintain a strong market cap amid the volatile nature of meme coins speaks volumes about its stability and investor confidence.

Recent activity on the 4-hour chart suggests that $MEW is gearing up for a significant movement. A potential double-bottom reversal, a classic bullish pattern, indicates that a bounce could be imminent. Currently, the baseline support is solid at $0.0031, with a neckline resistance at $0.0036. Breaking past this neckline is crucial for confirming the reversal pattern.

Source from CoinGecko

Should the bullish pattern play out as anticipated, $MEW could approach the overhead trendline near $0.0043. A breakout above this trendline could set the stage for a more aggressive rally towards $0.0065, coinciding with the 61.80% Fibonacci retracement level, a common target for traders using Fibonacci tools to gauge potential reversal points in price movements.

The optimism surrounding $MEW is palpable, fueled by its performance and the growing interest in meme coins that offer both a sense of community and investment opportunities. For traders and investors, understanding the sentiment and timing in such volatile markets is key. The potential for high returns is significant, but so is the risk, as meme coins can be highly sensitive to social media trends and broader market sentiment.

Investors considering $MEW should keep a close eye on volume and price action, especially as it approaches key resistance levels. Entering positions after a confirmed breakout could minimize risks associated with false breakouts. Moreover, setting strategic stop-loss orders below key support levels could protect against sudden downturns, which are not uncommon in the cryptocurrency market.

$MEW represents a fascinating case study in the meme coin phenomenon, blending humor with serious trading potential. Its current position and future prospects make it a compelling pick for those looking to diversify into digital assets that offer both fun and function. As the crypto landscape continues to evolve, $MEW’s journey will be one to watch, potentially leading the charge in the next wave of meme coin popularity.

Disclaimer: The projections and information presented here are for educational purposes only and should not be considered financial advice. CoinGrab.Asia assumes no responsibility for any losses resulting from the use of this data. Readers are encouraged to perform their own research and proceed cautiously before engaging in any related activities.