Crypto Markets Rally Amidst Massive Liquidations and Renewed Investor Interest

Following a period of intense sell-offs and heavy liquidations, the…

In the world of cryptocurrency, October has historically been a month of gains, and this year Ethereum has proven no different. Following a significant market dip that left investors cautious about the typical October rally, Ethereum has defied the odds by posting substantial gains.

The rally was led by Bitcoin, which soared to a peak of $66,000 after a brief pullback to $59,000, sparking a robust market recovery. Ethereum followed suit, with a dramatic rise from $2,300 to $2,650, marking a significant 6.52% increase in just one day, its largest since August.

The enthusiasm has not been limited to Bitcoin and Ethereum alone; sectors across the blockchain landscape saw remarkable uplifts. Public blockchain protocols like SUI and SEI, stablecoins such as ENA, and AI-driven tokens like ARKM and WLD all experienced notable increases.

The market’s bullish stance was also evident in the contract data, where bearish positions suffered heavily. Over the last 24 hours, the entire network saw a liquidation of $246 million, with $210 million coming from short positions alone. Open interest in BTC futures also surged to above $37 billion, indicating a strong bullish sentiment.

Further buoying the market, Bitcoin ETFs witnessed a record single-day net inflow of $253.54 million on October 11, the highest for the month. This influx of institutional money coincides with positive adjustments in federal monetary policy, with expectations of continued rate cuts through the end of the year, following a 50 basis-point reduction earlier this week.

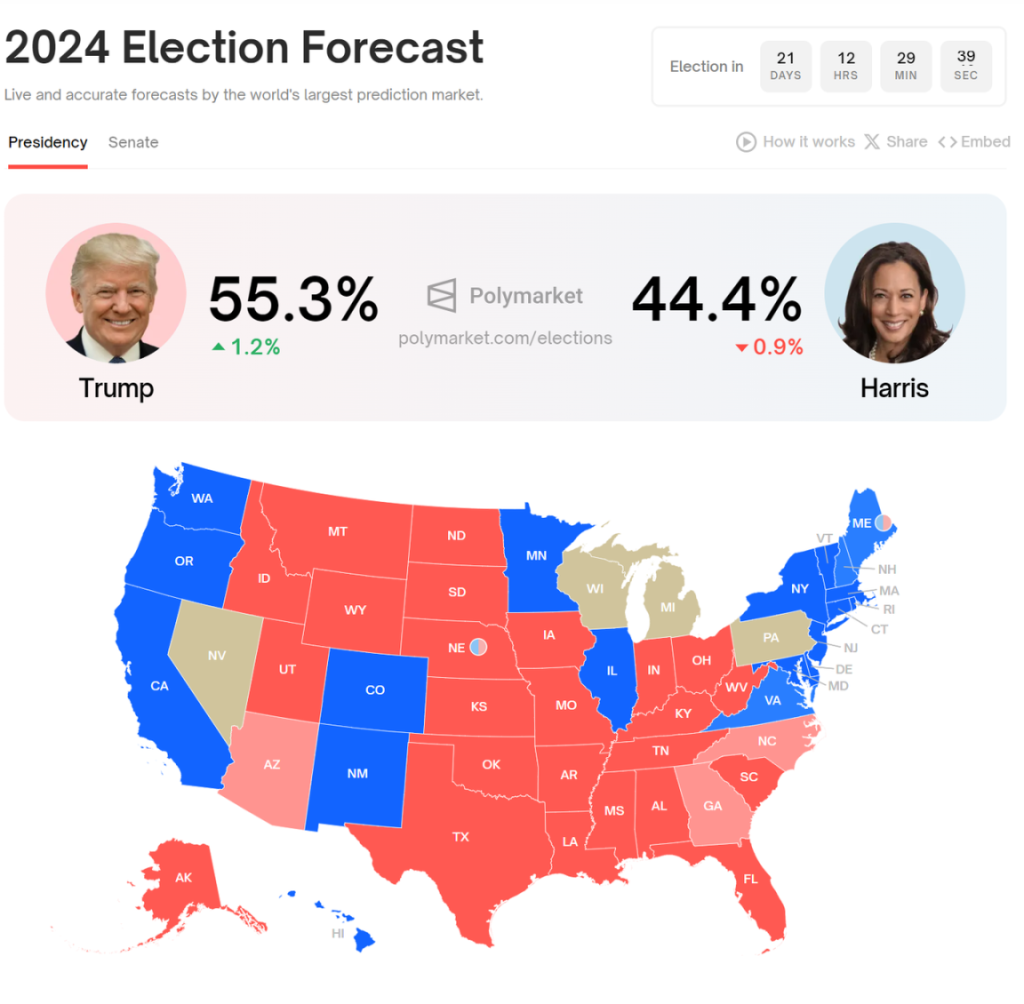

As the U.S. presidential elections approach, with results due on November 5, historical patterns suggest potential gains for the cryptocurrency market around election outcomes. This year, both candidates have shown a positive stance towards crypto regulation, promising a minimal negative impact regardless of the election result.

With the markets reacting positively to both political and economic stimuli, the stage is set for what could be a robust closing to the year for cryptocurrencies, particularly if the Fed’s easing continues as anticipated.