Solana (SOL) Set for Monumental Rise: Analyst Forecasts $1,000 Target

Potential Breakout Could Catapult Solana to $1,000 Solana (SOL) is…

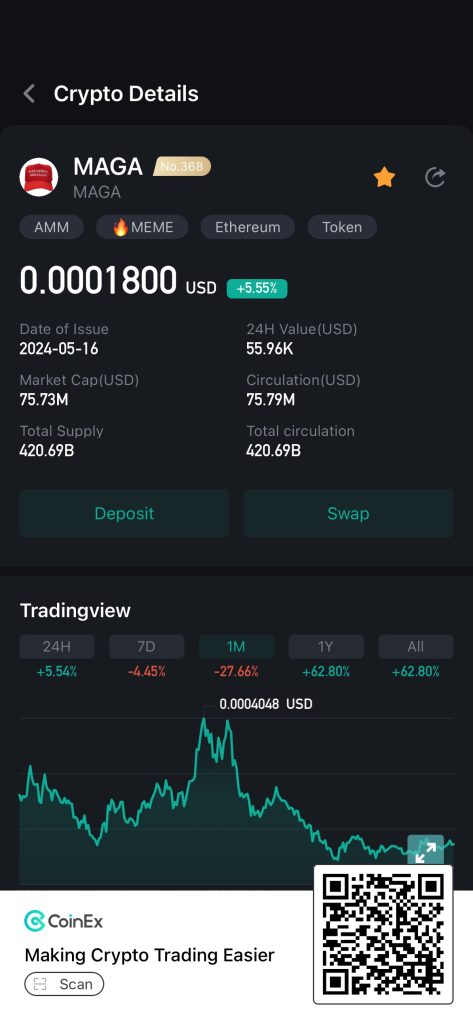

The MAGA token, a meme coin powered by artificial intelligence, experienced a significant price drop of 32% within the last 24 hours, settling at $0.0001795 as of 7 p.m. EST. Despite this, trading volumes surged by 28% to reach $145 million, indicating a heightened interest and activity around the token. This downturn coincided with the first presidential debate between Joe Biden and Donald Trump on 13 July where neither candidate addressed the topic of cryptocurrency, leading to a dip in investor confidence.

Investor sentiment was further swayed by speculation around President Biden’s perceived underwhelming debate performance, stirring rumors that he might step aside for a younger, more vigorous Democratic challenger to take on Trump. This political uncertainty has injected volatility into the MAGA market, affecting its price significantly.

Despite the sharp decline, MAGA token prices have shown signs of a robust recovery. After hitting a low of $0.0004097, prices found support at $0.0001886. This key support zone has provided a foundation for a potential bullish reversal, as evidenced by the token’s recovery to previous resistance levels.

The bulls are now endeavoring to propel the MAGA token above the 50-day and 200-day Simple Moving Averages (SMAs), which had been surpassed during the initial drop. A successful move above these averages could signify a definitive break from the bearish trendline and suggest a shift towards an overall positive market sentiment.

The Relative Strength Index (RSI) provides further insight, having recently bottomed out at the 30 oversold level. It has since shown a promising uptick, currently standing just below the neutral 50 midline at 47. This subtle reversal indicates building buying pressure, which could catalyze further gains for MAGA token prices.

Looking forward, if the bulls maintain their momentum, there is potential for the MAGA token to revisit and possibly surpass its all-time high, targeting the $0.0008180 mark in the forthcoming weeks. This ambitious target will depend on the token’s ability to overcome imminent resistance levels that could otherwise herald a bearish reversal. Should the bears retake control, the price might retract back to the support level at $0.0001886, presenting a significant pullback from current levels.

Investors and traders should keep a close eye on the political climate as it continues to influence market dynamics, particularly for politically-themed tokens like MAGA. Additionally, monitoring volume trends and RSI indicators will be crucial for predicting short-term price movements and potential entry or exit points.

In conclusion, while the MAGA token faces significant challenges ahead, the recent market activities and recovery attempts provide a glimpse of possible future gains. As always, potential investors should exercise caution and consider external market factors, especially those related to political events, which could drastically sway the token’s value in either direction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinGrab.Asia is not liable for any losses incurred from decisions made based on the content provided. Readers are encouraged to conduct their own research and consult financial experts before engaging in cryptocurrency trading.