Chainlink Price Analysis: LINK Eyes $20 Mark as Accumulation Trend Fuels Recovery

Chainlink Price Analysis: Recovery Gains Traction as Support Solidifies at…

Ethereum’s spot ETFs are becoming increasingly popular among traditional financial institutions, signaling a potentially underappreciated shift in the crypto investment landscape. While Bitcoin ETFs have historically dominated the market, Ethereum’s unique attributes are drawing more attention and capital inflow.

Since their launch in the United States on July 23, 2024, Ethereum spot ETFs have quickly become a focal point in the crypto investment world. Despite being operational for only six months—half the time since the launch of Bitcoin spot ETFs—Ethereum ETFs have shown impressive growth. By the end of July 2024, Bitcoin spot ETFs had attracted a staggering $17 billion in net assets, averaging over $100 million in daily net inflows, and led to a 50% price increase within two months following their approval.

Ethereum ETFs, however, have demonstrated even stronger initial performance relative to their market cap, which is about 30% that of Bitcoin. On their first day of trading, non-Grayscale Ethereum ETFs saw net inflows of $591 million, compared to $750 million for Bitcoin, accounting for 78% of Bitcoin’s inflows despite Ethereum’s smaller market cap.

The introduction of Ethereum spot ETFs has sparked a new wave of institutional interest, which could potentially outpace the influence of Bitcoin ETFs on their respective markets. Over the first week of trading, Ethereum ETFs garnered $1.494 billion in net inflows, significantly outpacing Bitcoin’s during a similar timeframe.

These developments suggest that Ethereum spot ETFs may not only replicate but potentially exceed the success of Bitcoin spot ETFs in shaping market dynamics and liquidity.

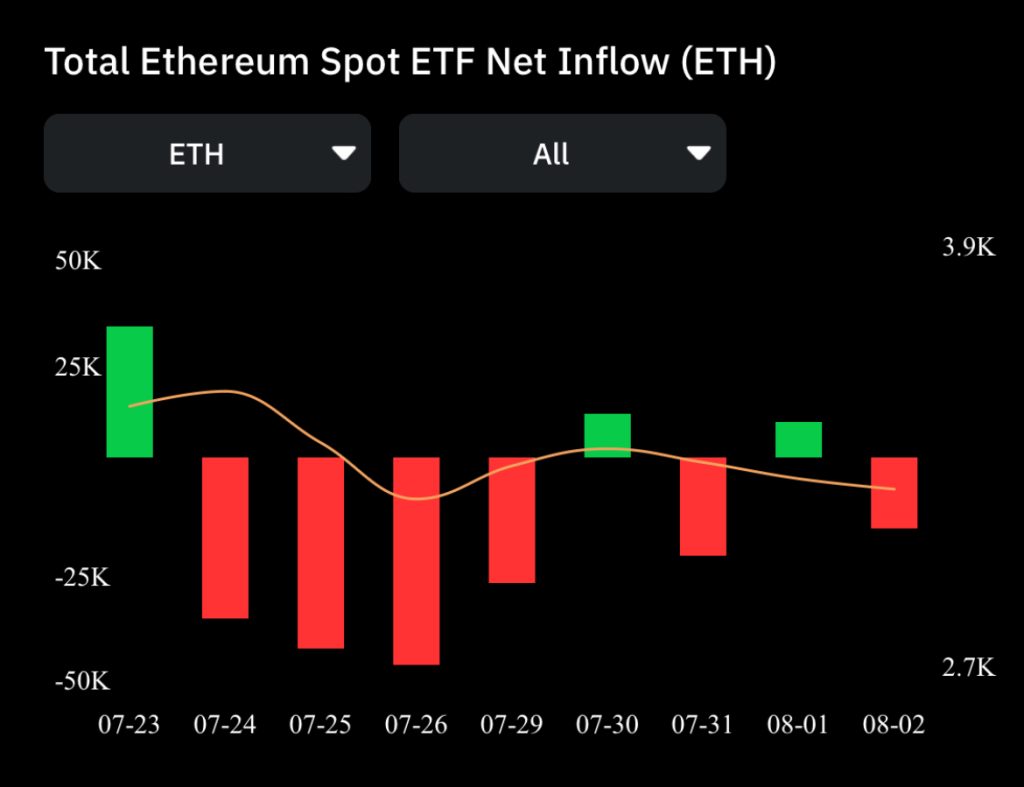

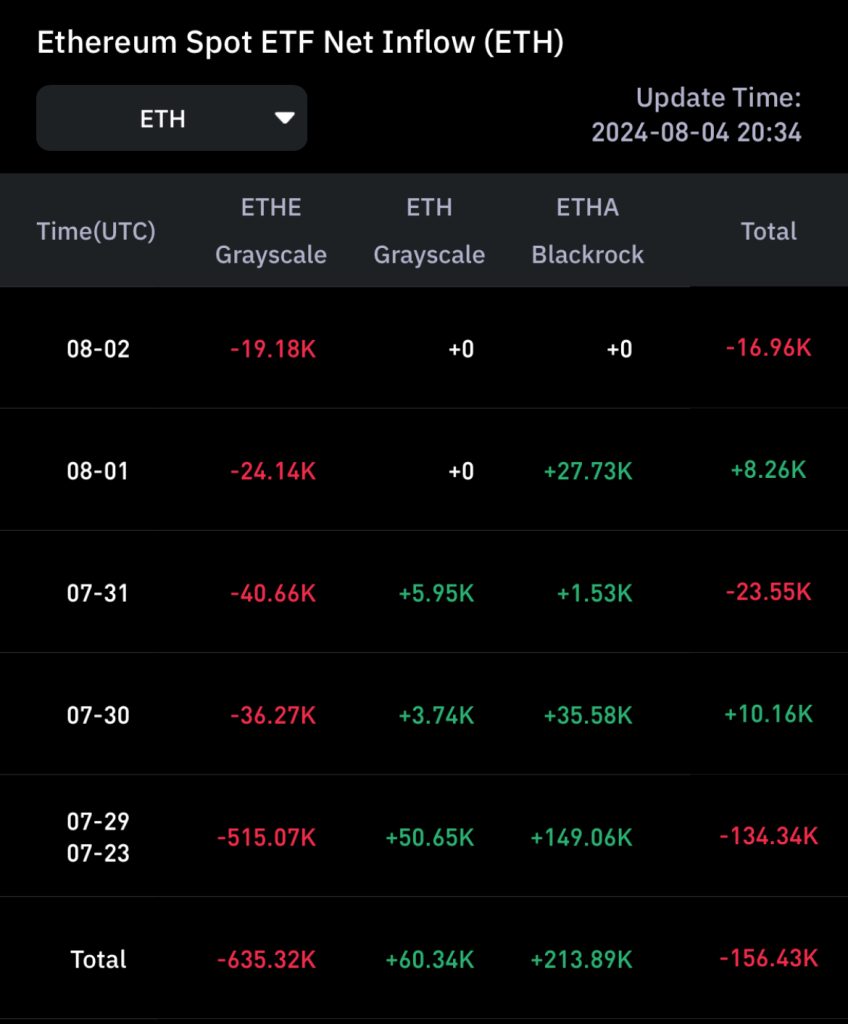

Despite the promising start, challenges persist, particularly from Grayscale’s large-scale sell-offs, which have pressured Ethereum’s price. However, as Grayscale’s influence wanes over time, Ethereum ETFs are expected to catalyze sustained inflows and increased market liquidity, potentially boosting Ethereum’s price similarly to Bitcoin’s experience post-ETF launch.

As Ethereum continues to carve out a significant niche in the crypto ETF market, the coming months will be critical in determining whether it can sustain the early momentum and truly rival Bitcoin in attracting institutional investment.

Ethereum’s utility as a platform for decentralized applications may play a crucial role in its appeal to traditional financial institutions, which are gradually recognizing the value of blockchain technology beyond mere digital gold.

Ethereum spot ETFs have not only matched but in some aspects, have surpassed the initial impact of Bitcoin ETFs on the market. This shift indicates a growing recognition of Ethereum’s potential within the traditional investment community, setting the stage for a new era in cryptocurrency investment dominated by utility and innovation over mere scarcity.

Disclaimer: The projections and information presented here are for educational purposes only and should not be considered financial advice. CoinGrab.Asia assumes no responsibility for any losses resulting from the use of this data. Readers are encouraged to perform their own research and proceed cautiously before engaging in any related activities.